Of interest

Consumer Dynamism

BAC Consumption Index (IC-BAC) is an indicator that monitors consumption in the region based on real-time

BAC International Bank

BAC International Bank Inc. (“BIB”) is a privately held Panamanian banking institution incorporated under the laws of the Republic of Panama. As a general license bank, it is under the supervision of the Superintendency of Banks of Panama (“SBP”) and as a bond issuer it is also regulated by the Superintendency of the Securities Market (“SMV”) and the Panama Stock Exchange (“Latinex”).

The supervision applicable to BIB is carried out on a consolidated basis, as it owns a number of subsidiaries (direct and indirect) through which BAC provides a wide variety of financial services in Central America: Guatemala, Honduras, El Salvador, Nicaragua, Costa Rica and Panama.

BAC is the leading financial group in Central America, with 5 million customers and a team of more than 20,000 employees in the region. The entity is committed to promoting economic, social and environmental prosperity in the countries where it operates, and is the first financial group in the region to adhere to the United Nations Principles of Responsible Banking.

BAC strives to be a bank that offers triple-positive financial solutions. This means that with the same excellence and rigor with which it works to maximize economic value, it also works to maximize and share social and environmental value with all stakeholders.

Board of Directors

Rodolfo Tabash Espinach – Director, Chairman & Regional Executive President

Education: Master's in Business Administration, INCAE Business School; Bachelor's in Business Administration, University of the Americas. Professional Experience: Country Manager of BAC International Bank, Inc. He has also served as Chief Corporate Banking Officer, responsible for developing the strategy and implementation of the Corporate Banking area in the Central American region. Mr. Tabash also worked as Commercial Banking Manager at Banco de San José in Costa Rica, Financial Manager of BSJ International Bank & Trust Company Ltd, and Deputy General Manager of Lachner & Saenz. In July 2016, he assumed the position of CEO at BAC Credomatic Network, replacing Ernesto Castegnaro.

Ana María Cuellar de Jaramillo – Director and Vice President

Education: Public Accounting, Jorge Tadeo Lozano University, Bogotá, Colombia. Professional Experience: Consultant; Active member of the Boards of Directors of Banco de Bogotá, Megalínea, Brío de Colombia S.A, Concentrados S.A, and Crump America S.A.

Daniel Pérez Umaña – Director and Secretary

Education: Master of Laws with a focus on Corporate and Financial Law, Harvard Law School; Master of Laws with a focus on Comparative Financial Law and International Dispute Resolution, Oxford University; Executive Program on Legal Aspects of International Business, INCAE/Georgetown; Specialist in Notarial and Registry Law, Universidad Escuela Libre de Derecho; Law Degree, University of Costa Rica. Professional Experience: Regional Legal Director, Grupo BAC Credomatic; Lawyer/Partner, Gómez y Galindo Law Firm (San José, Costa Rica).

Álvaro de Jesús Velásquez Cock – Director Treasurer

Education: Economist, University of Antioquia with a Master's in Economics from the University of London. Professional Experience: member of the Board of Directors of Banco de Bogotá, member of the Board of Directors of Corporación Financiera Colombiana, S.A, has been Director of the National Department of Statistics in Colombia. President of Pedro Gómez & Cía., S.A. and member of the Advisory Committee of the Financial Superintendence.

Carlos Ricardo Henríquez López – Independent Director

Education: Bachelor's degree in Business Administration from Florida State University, Master's in Business Administration from INCAE. Experience: Executive Vice President and General Manager of Banco Comercial de Panamá (Bancomer), member of the Boards of Directors of Banco Nacional de Panamá, Panama Stock Exchange.

Ana María Moreno Rubio – Independent Director

Education: Bachelor of Science, Business Administration and Management from Nova Southeastern University; Master's in Business Administration, ULACIT. Leadership and Executive Coach, Georgetown University. Legal Representative ______ 16 Experience: President and General Manager, Xcellentia; Senior Vice President of Development and Organizational Performance, Banco Latinoamericano de Comercio Exterior, S.A.; Senior Vice President of Human Resources and Corporate Operations, Banco Latinoamericano de Exportaciones, S.A.; Vice President of Human Resources, Banco General, S.A.

Diego Valdés Moreno – Independent Director

Education: Bachelor of Arts, Catholic University of America; Master's in Business Administration with a focus on Finance; Executive Programs, The Wharton School of Business, University of Pennsylvania; Ross School of Business; INCAE, among others. Experience: Executive Vice President and General Manager of Banco Comercial de Panamá (Bancomer), member of the Boards of Directors of Banco Nacional de Panamá, Panama Stock Exchange.

Patricia Beatriz Pascual Landa – Independent Director

Education: Law and Political Science degree from Santa María La Antigua University, Master's in Law from American University, Washington, United States of America. Experience: Associate at the law firm Alfaro, Ferrer & Ramírez, President and Member of the Vicente Pascual Barquero Foundation and Director of VP Investment Corp. She is currently a partner at the firm PAG Legal.

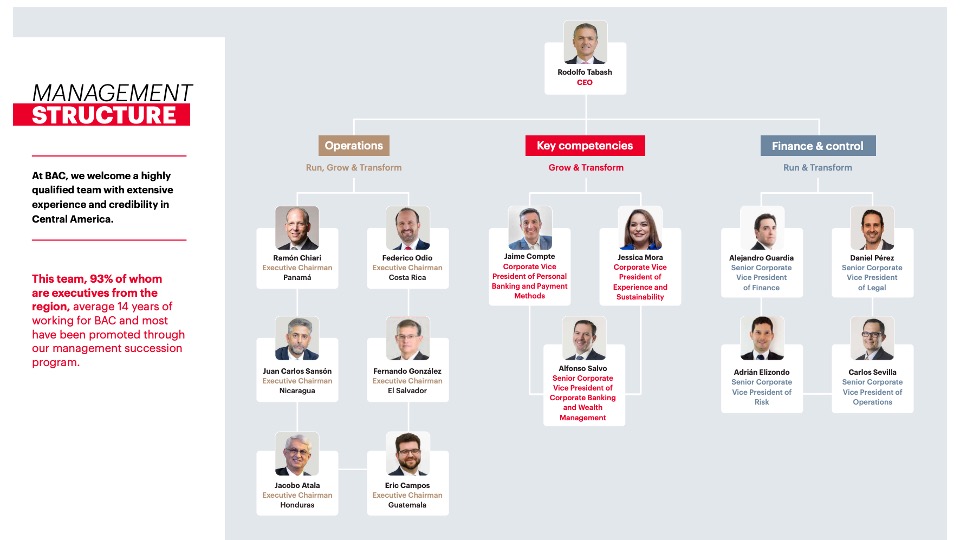

Executives of BAC

Purpose and Values

"Net Positive" Strategy

BAC aims to be the first financial group in the world to establish as its business strategy to become a Net Positive Bank, meaning that it will generate more environmental and social value than the footprint it creates through its operations in the 6 countries of the Central American region.

At BAC, we have defined that we no longer want to be a bank that offers traditional financial solutions, but we want to be a bank that offers financial solutions with triple positive value.

For the institution, generating triple positive value means that with the same excellence and rigor with which we work to maximize economic value, we will also work to maximize and share social and environmental value with all our stakeholders.

Financial Statements

Select a year to see information:

Bylaws/Corporate Agreement

Corporate Governance Code

The Board of Directors of BAC International Bank (hereinafter referred to as the "Company"), in fulfillment of its duty to direct and outline the Company's general corporate governance policy, has compiled in this Code of Corporate Governance some normative, regulatory and legal references, as well as certain internal policies and best practices that should guide the Company's development in matters of corporate governance.

The purpose of this document is to serve as a supplement to the legal and regulatory provisions applicable to the Company, as well as to the documents provided by the Company on corporate governance matters.

Board of Directors' Internal Regulations

The purpose of this document is to supplement the Articles of Incorporation ("Articles") of BAC International Bank (the "Company") in matters relating to the operation of the Board of Directors of the Company ("Board" or "Board"), in accordance with the provisions of the Articles, the Company's corporate governance documents and applicable laws.

Code of Ethics & Conduct

The Code of Integrity and Ethics outlines the general guidelines of conduct that must be observed and practiced on a daily basis by the directors, managers, employees and suppliers of BAC International Bank and its subsidiaries, so that their actions are consistent with the values of the company.

Conflicts of Interest Policy

This Policy applies to employees, members of the Corporate Governance Committee or members of the Board of Directors of BAC International Bank and its affiliates, hereinafter referred to as "BAC International Bank", and to transactions carried out (with its own resources or through the management of third party resources) between (a) BAC International Bank and its related entities, (b) between BAC International Bank, its related entities and persons related to such entities, and (c) between the administrators (the legal representative, the liquidator, the factor, the members of the boards of directors or of the committees of directors and those who, in accordance with the by-laws, exercise or hold such functions) and persons with decision-making power of such entities.

Policy for the Prevention and Control of Money Laundering and the Financing of Terrorism

BAC International Bank (BHI) is subject to the provisions of Part III, Title I, Chapter VII of the Basic Legal Circular (External Circular 029 - 2014) issued by the Superintendency of Finance of Colombia (SFC), which establishes "Instructions on the Prevention and Control of Money Laundering and Terrorist Financing for Issuers Not Supervised by the SFC".

Corporate Anti-Bribery and Anti-Corruption Policy

The purpose of this policy is to integrate the elements of the internal control system to prevent and manage corruption incidents in BAC International Bank (BHI) and its affiliates, to guide and promote the principles and values promulgated in relation to business ethics and corporate policies, and to guide the employees of BHI and its affiliates in the application of the policies defined in this policy.

Integrated Risk Management Policy

BHI and its financial subsidiaries manage risk in accordance with the regulations of each country in which they operate, best practices and internal policies, and promote a culture of risk prevention across all entities.

BAC Corporate Ethics Line

BAC provides its employees, suppliers, contractors, shareholders and other stakeholders with the BAC CORPORATE ETHICS LINE to promote compliance with ethical standards and to prevent potential fraud, malpractice and irregular situations within BAC and its related entities.

If you have knowledge of events or potential situations related to fraud, bad practices, corruption, money laundering and any other irregular situation, we invite you to report your case through this space.

The BAC CORPORATE ETHICS LINE has been set up under security parameters that guarantee the confidentiality of the information provided and protect the identity of the person providing the information.

Among the complaints that can be made through this line are the improper use and misappropriation of the Company's assets, intentional acts contrary to the values and principles of ethics and conduct, violation of the Company's rules, policies or procedures, unreliable financial information, improper disclosure of privileged or restricted information, and any other act considered contrary to the rules.

Remember that the Ethics Line is not a channel for receiving concerns or complaints.

Fiancial Statements

Condensed Consolidated Interim Financial Statements - September 2024

Año: 2024

Of interest

Sustainability

We want to contribute to the sustainable economic growth of all the communities in which we operate.